Energy Stocks: Running on Empty, or Fueled-Up for a Bull Run?

Editor’s note: Any and all references to time frames longer than one trading day are for purposes of market context only, and not recommendations of any holding time frame. Daily rebalancing ETFs are not meant to be held unmonitored for long periods. If you don't have the resources, time or inclination to constantly monitor and manage your positions, leveraged and inverse ETFs are not for you.

For a trader, watching a favorite sector languish while others mint money is the definition of frustration. And that’s the energy sector in 2023 in a nutshell for you. The stock market has had a pretty good run since the start of the year, taking most sectors with it. Those who bet big on big tech—especially the Artificial Intelligence theme—may be feeling pretty good about their bets. But energy has bucked the trend. Turns out a rising tide doesn’t always lift all boats. So, are energy stocks running on empty and about to take another hit, or can they get their act together and stage a meaningful rally?

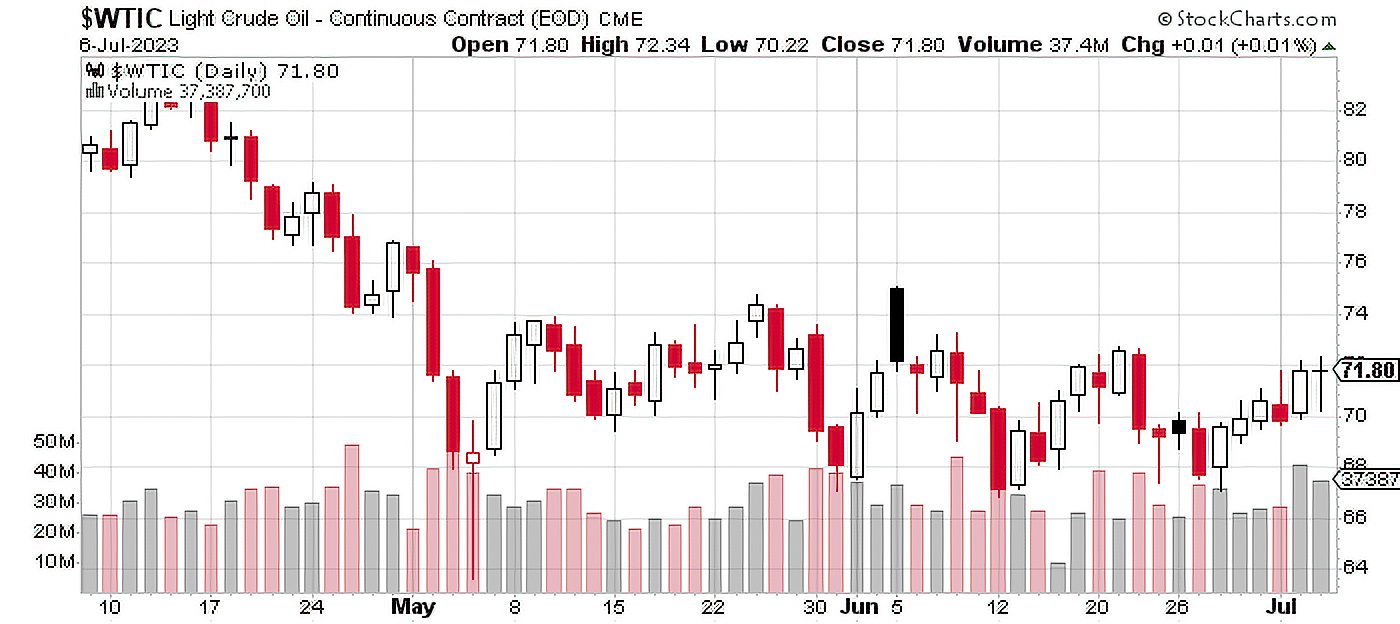

Source: StockCharts.com as of 07/06/2023

Candlestick charts display the high and low (the stick) and the open and close price (the body) of a security for a specific period. If the body is filled, it means the close was lower than the open. If the body is empty, it means the close was higher than the open.

The performance data quoted represents past performance. Past performance does not guarantee future results.

It's All About Crude, Dude

Energy stocks aren’t solely driven by the price of crude oil, but it’s certainly a huge factor for the sector’s direction. Think of oil as the LeBron James of the energy sector. If he’s out injured, things are going to be tough for the Lakers. Same with energy stocks. It’s difficult to have a bull market in energy names if their “power forward” crude oil is tanking.

So where’s crude headed? The jury is still out but here are some catalysts – for the commodity, and energy stocks – to keep an eye on:

- China: Crude has been on the back foot this year—down over 10% as of July 6, 2023. China’s economic reopening hasn’t been the big hit analysts hoped for and the country is a big buyer of crude and energy products. Economic data has been weak, and energy bulls will want to see this reverse. One release to watch: The next official manufacturing PMI* print, set to hit the tape on July 30. We’ve seen three months of readings under 50 (signaling potential contraction). Bulls on energy stocks hope the fourth time is the charm.

- OPEC: You can’t talk about oil without talking about OPEC. The cartel has been trying to protect its market with supply curbs but so far they haven’t managed to kickstart a rally in crude. OPEC’s next meeting looks like it will be in early August and traders may want to monitor media reports to see if further production cuts are planned.

- Stocks: Energy stocks and the broader market haven’t moved in tandem so far this year. But that doesn’t mean equities won’t have an effect on the sector in the coming months. If frothy markets take a nosedive, energy stocks could be collateral damage. Alternatively, it’s possible the energy sector plays catch-up and joins in the overall bull party.

Yearning for Earnings

Oil is a crucial driver of energy stocks but it’s not the only one. Like all stocks, earnings matter. And late July will bring earnings from two sector giants. Chevron Corporation and Exxon Mobil Corporation are expected report on July 28 and August 3, respectively.

Bull or Bear, Here’s Two Ways to Play Energy

Traders looking to bet on energy stocks can seek profit by trading the Direxion Daily Energy Bull (ERX) and Bear (ERY) 2X Shares. These daily leveraged ETFs seek daily investment results, before fees and expenses, of 200%, or 200% of the inverse (or opposite), respectively, of the performance of the Energy Select Sector Index.** There is no guarantee the funds will meet their stated investment objectives.

To view a list of the funds' holdings, please click here. Holdings are subject to risk and change.

*Definitions and Index Descriptions

An investor should carefully consider a Fund’s investment objective, risks, charges, and expenses before investing. A Fund’s prospectus and summary prospectus contain this and other information about the Direxion Shares. To obtain a Fund’s prospectus and summary prospectus call 866-476-7523 or visit our website at www.direxion.com. A Fund’s prospectus and summary prospectus should be read carefully before investing.

Leveraged and Inverse ETFs pursue daily leveraged investment objectives which means they are riskier than alternatives which do not use leverage. They seek daily goals and should not be expected to track the underlying index over periods longer than one day. They are not suitable for all investors and should be utilized only by sophisticated investors who understand leverage risk and who actively manage their investments.

The “Energy Select Sector Index” is a product of S&P Dow Jones Indices LLC (“SPDJI”), and has been licensed for use by Rafferty Asset Management, LLC (“Rafferty”). Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); and these trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by Rafferty. Rafferty’s ETFs are not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the Energy Select Sector Index.

**The Energy Select Sector Index (IXETR) is provided by S&P Dow Jones Indices and includes domestic companies from the energy sector which includes the following industries: oil, gas and consumable fuels; and energy equipment and services. One cannot directly invest in an index.

Direxion Shares Risks – An investment in each Fund involves risk, including the possible loss of principal. Each Fund is non-diversified and includes risks associated with the Funds’ concentrating their investments in a particular industry, sector, or geographic region which can result in increased volatility. The use of derivatives such as futures contracts and swaps are subject to market risks that may cause their price to fluctuate over time. Risks of each Fund include Effects of Compounding and Market Volatility Risk, Leverage Risk, Market Risk, Counterparty Risk, Rebalancing Risk, Intra-Day Investment Risk, Other Investment Companies (including ETFs) Risk, Cash Transaction Risk, Tax Risk, and risks specific to investment in the securities of the Energy Sector. Companies that engage in energy-related businesses and companies primarily involved in the production and mining of coal, development and production of oil, gas and consumable fuels and provide drilling and other energy resources production and distribution related services are subject to risks of legislative or regulatory changes, adverse market conditions and/or increased competition affecting the energy sector. Additional risks include, for the Direxion Daily Energy Bull 2X Shares, Daily Index Correlation Risk, and for the Direxion Daily Energy Bear 2X Shares, Daily Inverse Index Correlation Risk, and risks related to Shorting. Please see the summary and full prospectuses for a more complete description of these and other risks of each Fund.

These funds track a commodity related equity index, consisting of a basket of energy related stocks. They do not invest in physical commodities and should not be expected to directly track the performance of energy related commodities.

Distributor: Foreside Fund Services, LLC.